Insurance Information

Advanced Eyecare of Carteret works with many insurance carriers and payment plans.

We welcome all patients regardless of insurance coverage! If you don’t see your insurance company listed here, you can still be our beloved patient. Our friendly staff can provide an itemized receipt which can be used for insurance reimbursement. Since there are so many different health care plans available today, we encourage you to contact your plan provider directly for information regarding your unique coverage, benefits and process for claim reimbursement. Most insurance companies have made the steps very easy and they can be a great resource for helping you file a quick and efficient claim.

Please feel free to call us if you have any questions.

Insurance Participation

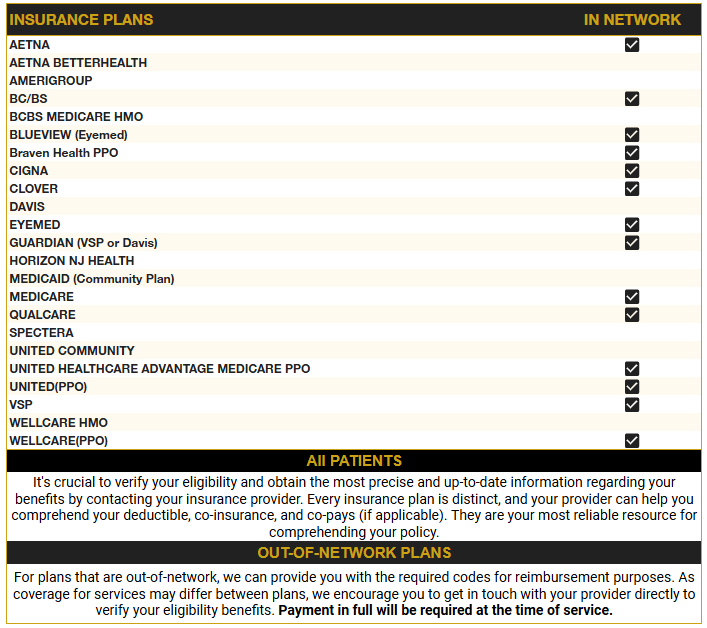

We participate with the following insurance plans:

If you don’t see your plan listed, please call our office to see if your plan is accepted. And remember to always check with your insurance provider for eligibility and the most accurate and up-to-date information regarding your benefits.

Payment Policy

Please have your insurance information available when making your appointment. If you do not have insurance, or your plan is not listed here – payment in due in full on the date of service. For your convenience, we accept Visa, Master Card, checks, and cash.

As a courtesy to our patients, we will file insurance claims for all insurance plans in which we participate. However, please keep in mind that you are ultimately responsible for payment. Any charges not covered by your insurance, are due and payable at time of service, or upon receipt of a statement from our office. Statements are mailed after insurance has processed your claim. Any reimbursement from your insurance carrier will be reflected on your statement. In addition, your insurance carrier will send an explanation of benefits that details how your claim was processed and paid.

It is the patient’s responsibility for any co-payments and deductible amounts or any non-covered services. Please note, any balance not covered by insurance is the patient’s responsibility.

Referrals and Pre-authorizations

If your insurance company requires a referral and/or pre-authorization, you are responsible for making sure that the referral and/or pre-authorization is obtained. Failure to obtain it may result in non-payment or a significantly lower payment from the insurance company, and the remaining balance will be your responsibility.

Please review your benefits with your plan administrator for detailed information regarding your coverage.

We know insurance can be difficult to understand since some plans do not cover all services. To make it easier, we have provided some information on terminology used and answers to frequently asked questions.

Insured Party: the patient who has insurance coverage.

Premium: the cost of the insurance plan paid in regular intervals by the covered individual and sometimes his or her employer. Medical service providers have little interaction with this portion of the consumer’s financial responsibility.

Co-payment (copay): the dollar amount that an insured party must pay toward a covered service at the time of care.

Deductible: a specified amount of money that the patient must pay before an insurance company will contribute to the cost of care in accordance with plan guidelines.

What is the difference between a vision exam and a medical eye exam?

Insurance coverage for eye exams varies. Some plans only pay for routine, well visits. Other insurance plans will cover an exam only if a medical eye condition or disease is present. Knowing the reason for your visit will allow our staff to bill your insurance properly and ensure you are receiving the appropriate care.

Some patients may have specific vision insurance to cover all or a part of this type of visit that is different from their medical insurance.

In order to better prepare for your visit we would like to provide an explanation of Medical vs Vision exams.

Vision Wellness Exam or Medical Eye Exam – The type of exam the insurance company billed is dependent on the purpose of the exam.

Which do you need?

A vision exam is defined as an exam addressing how you can see better via glasses, contact lenses or refractive surgery. It includes a screening for eye disease and it always includes a refraction. A refraction involves the measurement of the eye and generates a glasses prescription and the determination of the appropriateness of glasses or contact lens wear for you. If you wish to receive glasses or contact lenses then you will need a refraction as part of your exam. If you have a vision plan separate from your medical insurance company we will expect to bill your vision insurance for this exam.

A medical eye exam is defined by the need to diagnose a new medical condition or manage known medical condition that affects the eyes or optical pathways in the brain. A medical exam is typically covered by medical insurance and includes diagnosis and treatment of eye related medical diseases, such as glaucoma, macular degeneration, cataracts, corneal disease, eye infections, dry eye, pink eye, foreign body removal, headaches, and sometimes lazy eye, etc.

If the intention for your visit is to be evaluated for a medical eye condition, then notify the appointment scheduler that you need a medical eye exam. We will expect to bill your medical insurance for this exam. If your insurance requires a referral, please contact them to ensure one is on record before your appointment, unless you prefer to pay out in full on the day of service.

If at a vision wellness exam, the doctor suspects an eye disease is present, it is likely that you would be scheduled to return for a medical eye exam, utilizing your major medical insurance.

We advise you call your insurance company to verify benefits and coverage if you are unsure if you have both vision and medical coverage. Your insurance company is the best source to answer questions about your coverage. However, please keep in mind that the representative may not know your particular case. Please ask if the refraction code of “92015” is covered. Many times if you have both vision and medical insurance they are through two separate insurance companies so be sure to check for multiple sources of coverage, or contact your human resources department for help.

If your major medical also covers a refraction – yippee! Your life is simplified as now both vision and medical may be allowed at the same date of service.

If you have multiple eye issues please discuss your case with us as not all conditions can be addressed at the same date of service.